BANKING IS BELIEVING

News & Events

What's New

Branch Lobby FAQs

1. What precautions does GSB have in place? To maintain the health and safety of our employees and customers we are observing the following COVID safety protocols. Questions? Call our Resource Team at (207) 221-8432. Have PPE and hand sanitizer available for use Utilize germ shields at teller stations and customer service desks Direct traffic...

COVID

SBA PPP Funding Exhausted

After more than a year of operation, funding for the Paycheck Protection Program has been exhausted. The SBA will continue funding outstanding approved PPP applications. As of May 5, 2021, GSB will not be accepting any new applications. _______________ On December 27, 2020, legislation was signed that provides funding for a second round of SBA...

COVID

SBA COVID Relief for Restaurants

The SBA’s Restaurant Revitalization Fund (RRF) will open for application on Monday, May 3, 2021 at noon. The program provides emergency assistance for eligible restaurants, bars, and other qualifying food/beverage businesses who have experienced pandemic-related revenue loss. The American Rescue Plan Act established the RRF to provide funding to help restaurants and other eligible businesses...

COVID

SBA Coronavirus Relief for Venue Operators

The Shuttered Venue Operators Grant (SVOG) program application is slated to open April 8, 2021. The program was established by the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act and includes over $16 billion in relief to be administered by the SBA. Eligible applicants may qualify for SVO grants equal to 45% of...

What's New

A Third Round of Stimulus Checks

With Congress recently approving a $1.9 trillion COVID-19 relief bill, a third round of economic impact payments (stimulus checks) is expected starting March 17th. The bill provides $1,400 to individuals making up to $75,000 per year and $2,800 to couples making up to $150,000, with payments phased out for higher incomes. An additional $1,400 payment...

COVID

Grant for Businesses with Five or Fewer Employees

The Maine Department of Economic & Community Development (DECD) in partnership with the SBDC will provide grants of up to $5,000 for businesses with five or fewer employees, with an owner whose income is in the low to moderate range as defined by the Department of Housing and Urban Development (HUD). The second round of...

General

A Second Round of Stimulus Checks

With Congress recently approving a $900 billion COVID-19 relief bill, a second round of economic impact payments (stimulus checks) is expected starting the week of January 4th. The bill provides $600 to individuals making up to $75,000 per year and $1,200 to couples making up to $150,000, with payments phased out for higher incomes. An...

COVID

Maine Small Business Resources

We’ve compiled a list of business resources and links to assistance programs related to the COVID-19 pandemic. Paycheck Protection Program (PPP) Loans The SBA Paycheck Protection Program provides small businesses with forgivable loans to pay up to eight weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages,...

COVID

SBA EIDL Application Deadline Extended to 12/31/21

The SBA is accepting new Economic Injury Disaster Loan (EIDL) applications from all qualified small businesses, including agricultural businesses, and private nonprofit organizations. Businesses can apply online. The application deadline was extended to December 31, 2021. The SBA’s EIDL program is designed to provide economic relief to businesses that are currently experiencing a temporary loss...

Security

SBA PPP Borrower Data Publicly Released

Third-party businesses are using information from a court-ordered public release of Small Business Administration (SBA) Paycheck Protection Program (PPP) borrowers to deceptively market themselves. Their communications may reference Gorham Savings Bank and may even imply that we have an affiliation. Please be aware that we will communicate directly with you about your PPP loan and...

General

Tourism, Hospitality & Retail Recovery Grant Application Opens 12/3

On November 30, 2020, Governor Mills announced a $40 million economic recovery program to support Maine’s tourism, hospitality, and retail small businesses. The Tourism, Hospitality & Retail Recovery Grant Program is focused specifically on supporting Maine’s service sector small businesses, such as restaurants, bars, tasting rooms, lodging and retail shops, which have been hard hit...

COVID

Exceptions for PPP Borrowers of $50,000 or Less

On October 8, the SBA released a simpler Paycheck Protection Program (PPP) forgiveness application for small businesses. Under this streamlined forgiveness process, borrowers with loans of $50,000 or less are exempt from reductions in the forgiveness amount based on reductions in full-time equivalent employees, salary, or wages. The application and instructions can be found here:...

COVID

GPCOG Small Business Loan Program

Businesses with 25 or fewer employees can access forgivable loans designed to help alleviate the impact of COVID-19 through the Greater Portland Council of Government (GPCOG). Businesses must be located within Cumberland County, excluding Portland, Bridgton and Brunswick. Businesses with 25 or fewer employees can access loans of up to $10,000 – or $2,500 per...

COVID

Maine Economic Recovery Grant Program for Small Businesses

The State established the Maine Economic Recovery Grant Program with federal CARES Act funding to provide financial relief for businesses and nonprofits impacted by the pandemic. The grants will be awarded based on demonstrated need, not first-come first-served. The amount awarded will be based on a prorated percentage of the total cost of business interruption...

Security

SBA COVID-19 Relief Scams and Fraud Alerts

Please be aware of a variety of malicious attempts by cyber-criminals taking advantage of the Small Business Administration (SBA)’s COVID-19 relief efforts to gather sensitive information and steal funds from businesses. Always think before you click! Grants/Loans The SBA does not initiate contact on either loans or grants. If you are proactively contacted by someone...

What's New

PPP Loan Forgiveness Program

The SBA has created two applications – PPP Loan Forgiveness Application Form 3508EZ and PPP Loan Forgiveness Application Form 3508. Please refer to Application Form 3508EZ Instructions for Borrowers and Application Form 3508 Instructions for Borrowers to determine which application should be completed. Additional information regarding the use of SBA Form 3508EZ is also included...

Security

Unemployment Insurance Program Targeted by Fraudsters

The US Secret Service is warning of a well-organized fraud ring exploiting the COVID-19 crisis in order to commit large-scale fraud against state unemployment insurance programs. Individuals are receiving multiple deposits from various State Unemployment Benefit Programs. It is assumed the fraud ring behind this possesses a substantial database of Personally Identifiable Information (PII) in...

What's New

Portland Small Business Grant + Loan Programs

On May 19th, the City of Portland launched three new loan and grant programs for small businesses. Business Assistance Program for Job Creation (Rehiring) The City of Portland’s COVID-19 Business Assistance Program for Job Creation (Rehiring) (BAP) provides $5,000 in grant funding to small businesses for rehiring two or more full-time employees that were on the payroll as of January 31, 2020....

COVID

Payment Options

Manage your bills and payments remotely with our convenient banking technology. Zelle® Use Zelle in the GSB Mobile Banking App to send money to almost anyone you know1 – repay a friend or family member using only an email address or U.S. mobile number. Get Started With Zelle External Transfer Transfer funds...

COVID

Coronavirus Scams

As the novel coronavirus (COVID-19) pandemic continues to impact the United States, fraudsters have seized the opportunity to prey on businesses and consumers. Scams are coming in many ways – not only through email, but also by phone, text, and social networking sites. They are also taking many forms, from fake Paycheck Protection Program loan...

COVID

FAME COVID-19 Loan Relief Program

FAME is offering special terms to eligible Maine businesses that have experienced interruption or hardship due to COVID-19. Various programs include: Direct loans up to $50,000 offered at reduced interest rates; Commercial loan insurance for Maine lenders of up to 75% on loans up to $100,000; and Direct loans of up to $100,000 with special...

COVID

Budgeting in a Crisis

When a crisis like COVID-19 hits, the impact it can have on your budget and your lifestyle can be significant. A crisis budget can help you prioritize bills that need to be paid and adjust your daily spending if you have to live on a reduced income. Focus Only On The Necessities: Rent/mortgage Utilities Groceries...

COVID

Understanding FDIC Insurance

The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category. Deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at...

COVID

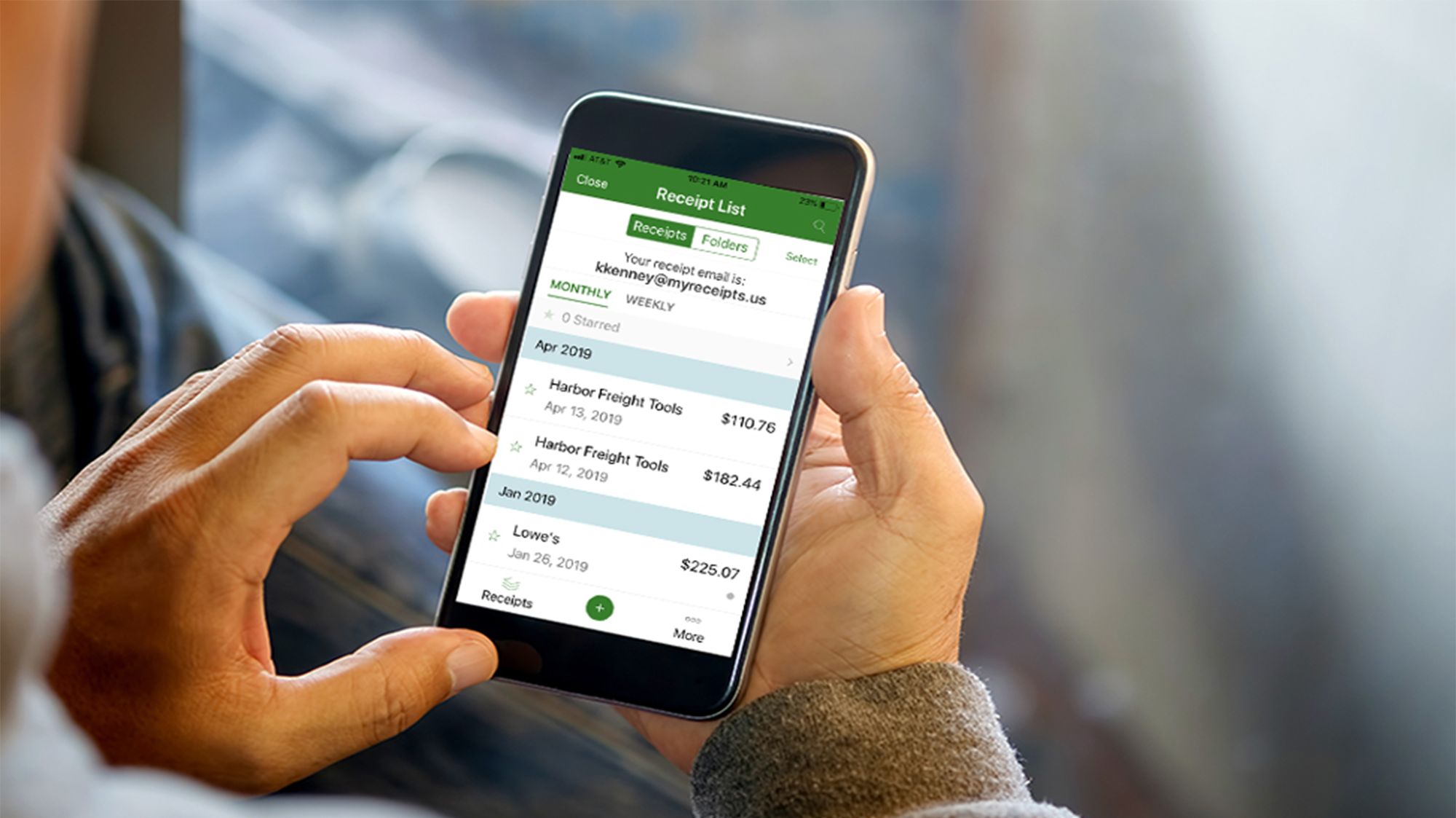

Remote Banking Options

Manage your GSB accounts remotely with our various banking technology. Online Banking Access account information, transfer money and pay bills from home. Enroll in Online Banking GSB Mobile App Manage your accounts from your couch – and take advantage of mobile check deposit. Download for iPhone or Android Video Teller Machines Touch the screen to speak...

COVID

Community Resources

We’ve compiled a list of resources and links to assistance programs available during the current COVID-19 health crisis. General Assistance Call 211, email info@211maine.org or visit 211Maine.org for a local directory of services, including financial assistance, food resources, housing, health care services, and child care. Food Assistance Cumberland County Food Security Council: Community...